COVID-19 is changing how B2B buyers and sellers interact. Savvy sales leaders are learning how to adapt to the next normal.

OVID-19 has destroyed lives and livelihoods and continues to do so in many communities around the world. Although the full implications of the pandemic are far from certain, it is already clear that its economic consequences are dire.

For sales leaders contemplating how to react, taking care of their people and customers must be a top priority. Even as they manage that reality, sales leaders also need to adjust how their organizations sell in the face of new customer habits and trying economic times. In many ways, the changes in customer behavior are an acceleration of digital trends that were in motion before the pandemic hit. We believe we are at a digital inflection point, where B2B sales operations going forward will look fundamentally different from what they were before the pandemic.

To better understand how both customers and sellers are reacting, we launched a survey of B2B businesses across 11 countries in seven sectors and across 14 categories of spend.1 These findings reveal three emergent themes that we will continue to track:

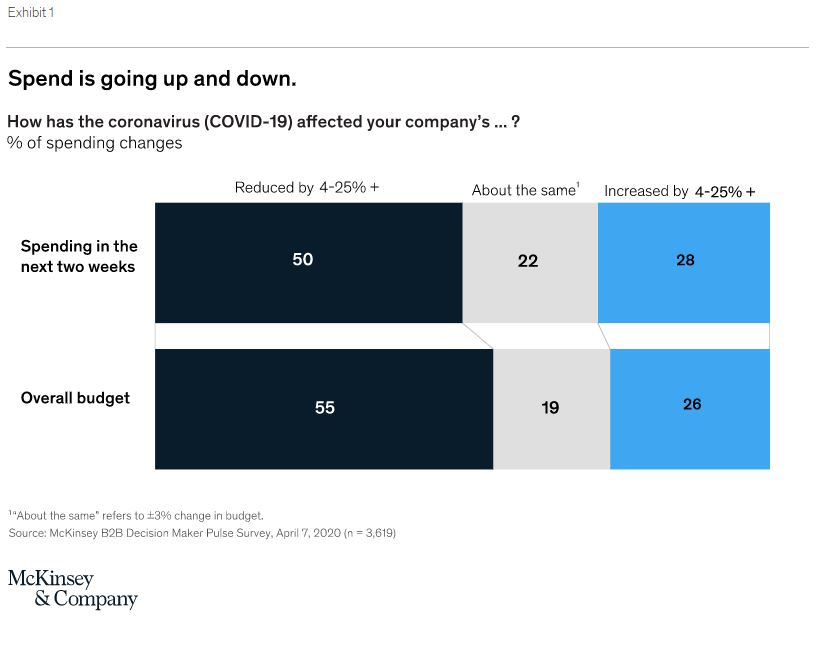

- Spend. While companies are generally reducing spend, a sizable number are increasing or maintaining it, with rates depending on company size, sector, and—more than any other factor—location in the world.

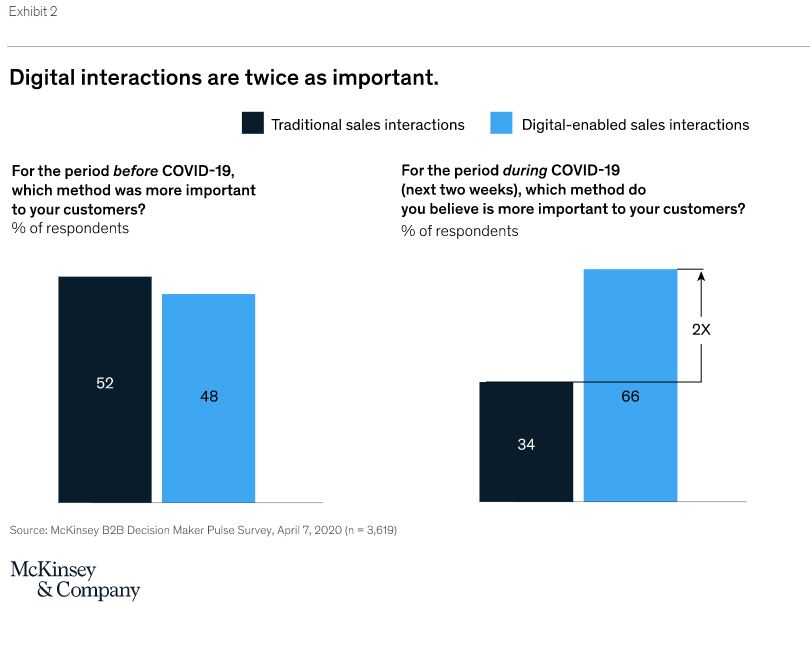

- Digital. Looking forward, B2B companies see digital interactions as two to three times more important to their customers than traditional sales interactions.

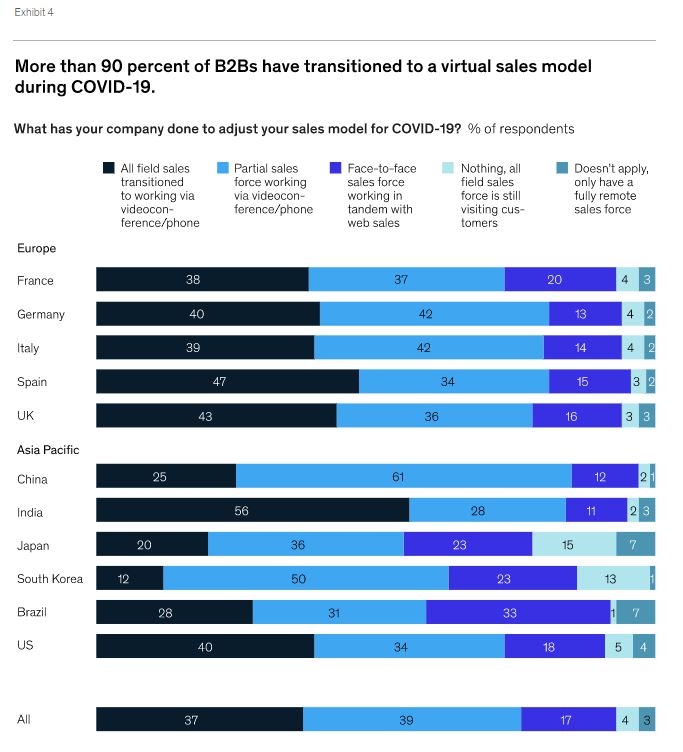

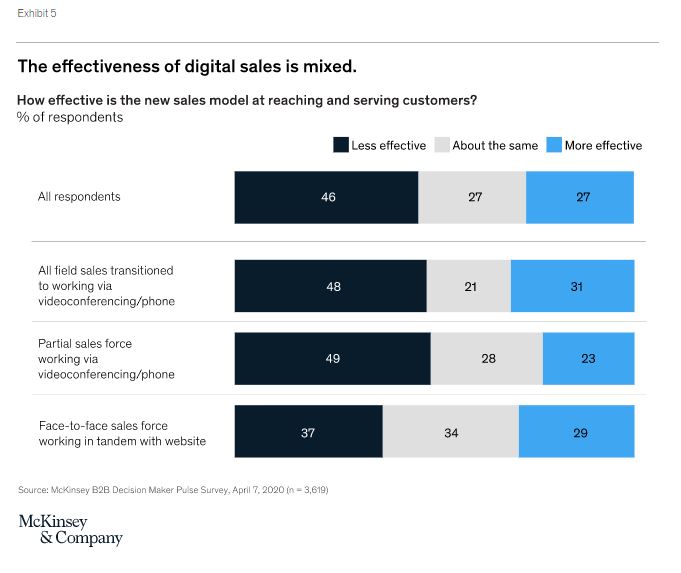

- Remote. Almost 90 percent of sales have moved to a videoconferencing(VC)/phone/web sales model, and while some skepticism remains, more than half believe this is equally or more effective than sales models used before COVID-19.

We hope the insights from this survey can help sales leaders calibrate their responses and navigate their organizations through the three phases of the COVID-19 response: 1) navigating the current crisis with resolve and resilience, 2) planning for the recovery, and 3) reimagining the next normal. Clearly there is a great deal of uncertainty, but we are seeing plenty of signals that indicate an acceleration of previous trends—omnichannel selling, inside sales, tech-enabled selling, e-commerce—rather than completely different behaviors.

Sales leaders are already moving quickly to navigate the crisis, with the best ones focusing on how to make targeted changes that help their businesses weather the storm and start preparing for the recovery. As we update this survey in the coming weeks, we will also share perspectives on planning for the recovery as well as reimagining the new normal for sales.

The shift in spend

Given some of the grim economic signals, we would have expected more drastic reductions in spend. But a sizable number are maintaining or even increasing it, at least for now. That is especially true for large B2B companies, 53 percent of which expect to increase or maintain spend over the next two weeks (April 8–21, 2020). In 85 percent of the cases, the rate of change in spend—either up or down—was no more than 25 percent of total spend (Exhibit 1).

This thread of optimism carried through across sectors, with those in pharma, medical products, technology, and media expecting the greatest increase in spend, while travel and global energy and materials expected the least.

These spend patterns play out in a similar way by geography, though US companies cited increasing or maintaining spend at a higher rate than their European counterparts. Chinese and Indian decision makers cited even higher rates of increasing or maintaining spend, with Indian companies notable for the vast majority responding that they are changing spend—36 percent increasing it and 46 percent cutting back—while only 16 percent are maintaining it.

The shift to digital

This shift in the importance of digital interactions is reflected in customer behaviors. When researching products, customers’ preference for digitally enabled sales interactions has jumped significantly, with suppliers’ mobile apps and social media or online communities showing their sharpest increase since 2019. Mobile apps are twice as important for researching products among Chinese buyers as they are for those in the UK or Germany. Interestingly, the importance of a supplier’s web page did not change much, likely because customers were already actively using supplier websites for this part of their journey.

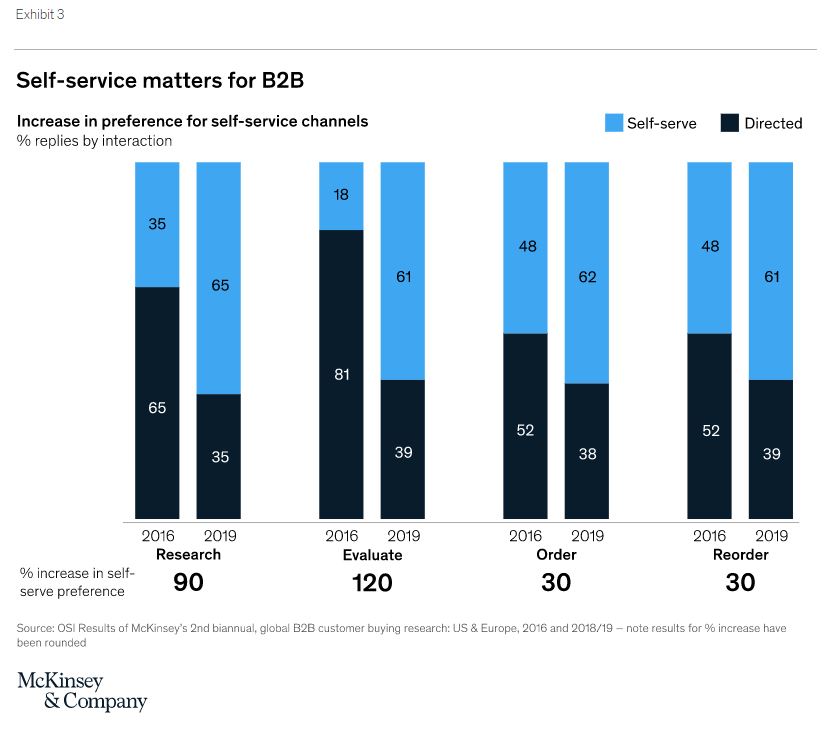

In making a purchase, buyers cited a strong preference for self-service, with suppliers’ mobile apps more than doubling in importance since 2019. This carries on a pronounced trend of preference for self-service channels across every stage of the customer decision journey, which we first started tracking in 2016 (Exhibit 3).

But it is not enough to give customers multiple self-service options. Consistently getting the options right matters a lot. Buyers no longer are willing to accept less from their professional experience as B2B purchasers than they are accustomed to getting from their personal experience as consumers. Results in our 2019 survey showed that those suppliers who provide outstanding digital experiences to their buyers are more than twice as likely to be chosen as a primary supplier than those who provide poor experiences, and about 70 percent more likely than those providing only fair ones.

Within that context, we found that “getting it right” means delivering on the three things buyers value most: speed, transparency, and expertise. Those priorities apply across all channels, and they are more pertinent now than ever. For example, 33 percent of buyers surveyed rated the option of live chat during the research stage of their buying journey as one of the top-three requirements for a best-in-class supplier. Live chat, for example, is an option that delivers speed, transparency, and expertise—things that customers value most.

To deliver outstanding digital experiences and encourage loyalty, B2B companies need, at a minimum, to address customers’ most pressing pain points and frustrations. When we asked our sample of decision makers to select their top-three most frustrating issues with suppliers’ websites, 36 percent cited the length of the ordering process, 34 percent the difficulty of finding products, and 33 percent technical glitches with ordering. Other common concerns were confusing websites, a lack of information on delivery and technical support, and difficulty setting up payments.

The move to remote selling

The effectiveness of the move to remote working, however, is up for debate among B2B decision makers (Exhibit 5). For every respondent who cited it as “less effective,” there was another who thought it was equally or more effective. We did find some differences by country, however, with India and the US rating remote working highest in perceived effectiveness, at 68 and 60 percent, respectively.

The sudden and massive shift to remote working prompted by the COVID-19 pandemic and the “consumerization” of B2B buying that was already underway have profound implications for how companies sell to and buy from one another. Sales leaders are already moving aggressively to adjust to the COVID-19 crisis. In addition to adjusting sales forces to remote working, about 70 percent of companies have also established multi-disciplinary commercial nerve centers to manage sales operations during this time.

While most sales leaders accept the need for a move to increased use of digital channels (many, in fact, have made significant adjustments since quarantines started), it’s not as simple as just “moving to digital.” The sharp rise in the use of digital and self-service channels means that companies need to be thoughtful not only about how to enable effective digital interactions but also about how to deploy their sales reps to best effect. Re-orchestrating the customer experience and the accompanying sales processes across channels should be at the top of the list for sales leaders trying to manage effectively through this crisis and plan for recovery. So should determining how best to deploy sales professionals across channels to help customers and provide support when it is most needed.

In an environment where habits and practices have changed so quickly and will likely continue to do so, sales leaders need a clear view of what their customers want and what steps their company can take to address their needs. Traditional face-to-face interactions have given way to sales and service support by videoconference, webinar, phone, human chatbot, and other means. In this remote and digital world, however, there is still a crucial role for the human touch.

Information via Ryan Gavin, Candace Lun Plotkin, and Jennifer Stanley. Partners at McKinsey & Company.