Mitigating the risk of a security breach and protecting customer data is one of many concerns that need to be addressed with innovative technological solutions and methods. Biometric authentication is one such solution to this problem. With rapid innovation in this field, new companies and use cases are coming up in order to provide secure and convenient authentication processes to users.

Governments and various industries are trying to implement mobile biometrics to speed up the process of biometric authentication. Individual biometric identification can be achieved on a mobile device either through its built-in biometric sensors or by attaching portable biometric hardware to it via a USB cable or through a Wi-Fi connection. The global biometric authentication and identification market is expected to undergo considerable growth over the next five years. The market size for biometrics is expected to reach $24.59 billion in the next six years, according to Grand View Research.

Here are some of the major technology and market trends in this segment:

1. Biometrics is expanding to the retail and consumer market to address problems with the current PIN and password authentication.

Most commonly, current authentication methods don’t provide the security that is actually needed. Passwords can be hacked and socially engineered from personal information that is readily shared on social media. PINs are not unique; the 20 most common combinations represent over 25% of in-use four-digit passwords. Companies like Microsoft andIntel are implementing biometric authentication systems into their future products to protect user credentials. Biometric single sign-on (SSO) is a biometric password management technology that secures passwords & networks and protects data from unauthorized access & security breaches.

2. Smartphone manufacturers are turning to biometrics to authenticate device access.

The number of global biometric smartphone users will rise to 471M in 2017, up from 43.23M last year. (Source:Biometrics Go Mobile: A Market Overview). According to Gartner, 30% of mobile devices will be using biometric authentication by 2016.

3. Biometric modalities fueling the growth in consumer and retail are focused more on convenience than security.

There are different modes/methods of biometric authentication such as fingerprint, voice, retina, heartbeat, facial and others. Fingerprint biometrics, the least secure modality, is becoming mainstream with annual sensor shipments estimated at 1.4 billion units by 2020, up from 317 million in 2014. Bank of America recently introduced fingerprint and Touch ID sign-in for its mobile banking apps. With this feature, customers can use their fingerprints as a passcode for their mobile banking app. The main aim behind this new authentication facility is to provide its customers with secure and convenient banking. The new feature from banks will remove the need of text-based passcodes from users.

4. Biometric solutions are being deployed for multiple payment use cases, including leveraging smartphones for POS purchases and using biometrics as a second form of authentication at ATMs.

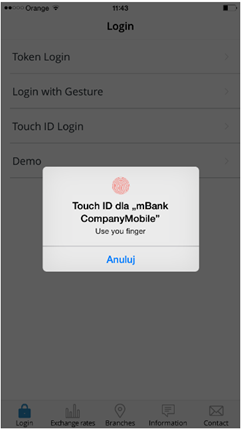

For example, Apple Pay is making mobile POS payments via smartphones much more secure by using fingerprinting in its Apple TouchID biometric system to verify a user’s identity and simplify the online and mobile process. Earlier, Touch ID was limited to the App Store, iTunes purchases and unlocking the device. The announcement caught the attention of banks and we witnessed Touch ID being used for accessing mobile banking services. Some of the banks who have already adopted Touch ID in their mobile banking apps are American Express, ING Bank, OutBank DE and Deutsche Bank.

5. Biometrics for mobile banking:

Biometric authentication seems to be an absolute must-have in the near future for banks, especially taking into consideration how mobile banking is getting popular. It seems to be a milestone when considering the future of mobile applications. If banks desire to remain competitive, they should anticipate customers’ expectations and needs. However, the key idea is to combine innovations with taking care of clients’ convenience and payments’ safety.

6. Multifactor biometric authentication: Organizations are now seriously considering multifactor biometrics like fingerprint, retina, voice, retina, facial and heartbeat for authentication as it has a lot of significance in online/mobile banking. Banks have started working with technology firms, developers and startups in order to create fool-proof authentication systems which will be the key to a great mobile banking and mobile payments experience. Wells Fargo is the first US-based financial institution to pilot a fusion of voice and face biometrics to authenticate customers, a feature that is being rolled-out to CEO Mobile’s iPhone app users in 2016. By identifying a customer’s face, voice and mobile device, biometric authentication makes it extremely difficult to spoof the true user.

7. Industry-specialized biometric solutions: Various kinds of solutions are designed to meet the unique demand of respective industries. The solutions are customized according to the local and international industrial laws and standards. For example, CertisID provides a specialized biometric solution for the financial services industry. It is designed to provide security and reduce fraud, providing a complete audit trail for both customer and employee activity. Another example is RightPatient, a company in the healthcare sector that facilitates a higher level of accuracy for patient identification, and unifies big data and clinical knowledge in healthcare in an unprecedented way to drive personalized health, decision support and predictive analytics.

By: Amit via letstalkpayments.com