What is a surcharge? It’s a small fee imposed on credit card transactions in order to offset a merchant’s credit card processing costs.

If a business owner imposed a 3% surcharge on credit card transactions, for example, an item with a list price of $10.00 would cost $10.30 for a customer paying with a credit card. Surcharges are exclusive to credit cards—while debit cards do carry a transaction fee, it’s illegal to charge customers for processing them.

A tumultuous history

For decades, business owners and credit card issuers have been squaring off in the courtroom to determine the legality of imposing a surcharge on credit card transactions. Business owners want the option of imposing surcharges to improve their bottom line, while card issuers oppose surcharges because they discourage the use of credit cards.

Visa and Mastercard quieted the debate for a time by instituting contractual bans on surcharges, but it reignited in 2012 when the card brands decided to lift the bans as part of a settlement for an antitrust lawsuit brought against them by millions of retailers.

The removal of the contractual bans prompted a number of surcharge-related lawsuits, as several states had legislation in place that outlawed the practice. In 2013, a group of retailers in New York City filed a suit against the attorney general, claiming that the section of New York General Business Law that prohibited surcharging violated certain constitutional rights. After a protracted battle, the retailers successfully proved the law banning surcharges unconstitutional. Leveraging surcharges on credit card transactions became legal in New York as a result of this decision, which set a precedent for retailers in other states.

Surcharge bans have now been challenged in California, Florida, and Texas, leaving only six states in which surcharging remains illegal—at least for the time being.

Provisions and obstacles

Discover and American Express have permitted merchants to surcharge on credit card transactions for years, but only provisionally. Merchants have to apply surcharges to all accepted credit card brands, so as not to encourage consumers to choose one brand over another.

American Express’ Merchant Reference Guide states, “Merchants must not impose any restrictions, conditions, disadvantages, or fees when the [American Express] Card is accepted that are not imposed equally on all Other Payment Products, except for electronic funds transfer, or cash and check.”

This means that as long as Visa and Mastercard’s contractual bans on surcharging remained standing, merchants couldn’t impose surcharges on any credit card transactions because they were unable to subject all card brands to the same charge. It would create unfair advantages for Visa and Mastercard if merchants were to surcharge only transactions completed with Discover and American Express cards.

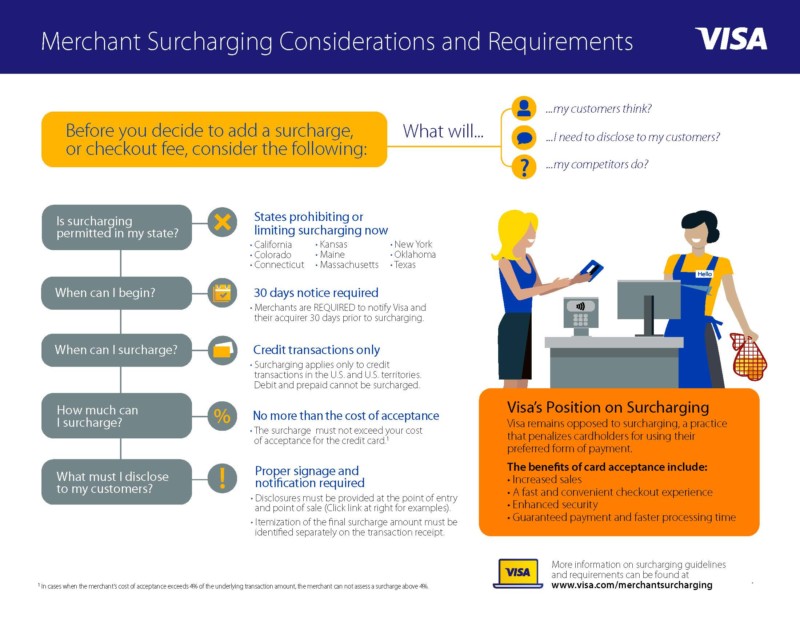

Even now that the bans have been lifted and surcharging is permitted in most states, the guidelines for implementing the fee are stringent and complex. Each card brand has its own parameters for imposing surcharges, but all card brands must be subject to the same rules and charges so that none is favored over the other. Various entities—the card brands, acquirers, networks, etc.—require notification before a business begins surcharging, and the process can be long and complicated.

Source: www.visa.com

*As of 2019, California, New York, and Texas permit surcharging.

The hoops alone may be enough to dissuade business owners from exploring the option, but for those who like a challenge, here are the pros and cons of imposing a surcharge on credit card transactions.

Pros:

- While surcharging probably won’t negate credit card processing costs entirely, it can certainly help defray them. Passing on processing fees to consumers directs a higher percentage of sales revenue into your bank account.

- Processing fees fund credit card rewards programs and enable the convenience of card use, from which consumers benefit, so surcharging relieves you as a business owner of the burden of bankrolling programs that offer no advantages to you.

- If the prices of your products or services already account for processing fees, the introduction of a surcharge would allow you to lower them to more competitive levels.

- Introducing a surcharge may encourage your customers to pay with debit cards or cash instead of credit cards. Debit cards, while illegal to surcharge, carry lower processing fees, and cash carries no fee.

Cons:

- A customer might not be put off by a 3% upcharge on a smaller purchase, but if your business sells big-ticket items that your customers usually purchase on credit, a surcharge may become a deterrent.

- If you have nearby competitors who don’t surcharge, you may inadvertently drive business in their direction by imposing the fee.

- Numerous polls show higher rates of reluctance to pay surcharge fees among certain age groups (70% for those aged 50-64, and 75% for those 65 and older). If the majority of your clientele falls within those ranges, surcharging may actually hurt your bottom line rather than improving it.

- Surcharging requires strict compliance with numerous sets of guidelines, and you may need to update your POS system if it doesn’t support automatic surcharge inclusion.

So you decided to surcharge

Surcharges can be leveraged on face-to-face, eCommerce, and unattended terminal transactions, as well as mail and telephone orders. Each transaction type requires specific signage or alerts so that customers are aware of the additional expense.

Source: www.visa.com

The permitted surcharge rate caps at 4%, but a business’ individual rate is calculated based on its average effective processing fee rate, calculated over a 12-month span. The surcharge may not exceed the effective rate.

An alternative option (and a workaround that companies could employ even when contractual bans on surcharging existed) is offering a cash discount. Rather than upcharging credit card users, merchants can offer reduced costs for customers who pay with cash or debit.

Whether you choose to surcharge on credit card transactions or not, there are other ways to help your bottom line. One option might be finding a more affordable payment integration solution. The complex breakdown of credit card fees leaves a lot of room for confusion, and there’s a good chance you’re overpaying and don’t even know it. You may prefer to pass your credit card processing fees on to your customers, but it’s still your responsibility to understand your effective rates and your pricing plan. If your bill looks like several pages of gibberish littered with ambiguous charges, or your effective rate exceeds 4%, it’s time to find a trustworthy payment processor with transparent, reasonable rates.